Bitcoin Steady Above $118K Ahead of FOMC And ETH ETF Breaks Records – What Are The Best Altcoins to Invest In?

The crypto market took a mild hit today, with total capitalisation falling by 2% to $3.91 trillion. The market may face increased volatility ahead of the FOMC meeting later today, as investors await key signals from the Federal Reserve. With the CME FedWatch Tool showing a 96.9% probability that interest rates will remain unchanged, most expect a pause rather than a pivot. Bitcoin price remained relatively steady, trading between $118,000 and $119,000 after recovering from a drop to $115,000.

Ethereum, however, continues to hold strong above $3,700, bolstered by a record $5.2 billion in net inflows into spot ETH ETFs. Clearly, we’re seeing a rotation from Bitcoin into altcoins, at least for now, so what are the best altcoins to buy in anticipation of a possible altcoin season?

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Best Altcoins to Buy Right Now? From ETH To Hyperliquid and Solana Offer Unique Upside for August 2025

ETH ETFs saw $65.14 million in inflows, with BlackRock’s ETHA leading the charge at $131.95 million. ETH ETFs now hold $21.5 billion in assets and are becoming an increasingly important part of the altcoin landscape.

Corporate treasuries are now accumulating ETH, with firms like SharpLink Gaming surpassing the Ethereum Foundation’s holdings. Over $1.6 billion in ETH has been acquired by major corporations in the past month, suggesting long-term conviction.

$ETH ETF inflows are absolutely skyrocketing right now.

Follow the smart money! pic.twitter.com/BCh8g0ULdA

— Mister Crypto (@misterrcrypto) July 29, 2025

Ethereum remains the leading altcoin and a key signal for broader market trends. With spot ETH ETFs now logging 17 consecutive days of inflows totaling $5.2 billion, institutional confidence is surging. ETH/BTC technicals have flipped bullish, and analysts increasingly view Ethereum as the foundation of the next crypto cycle.

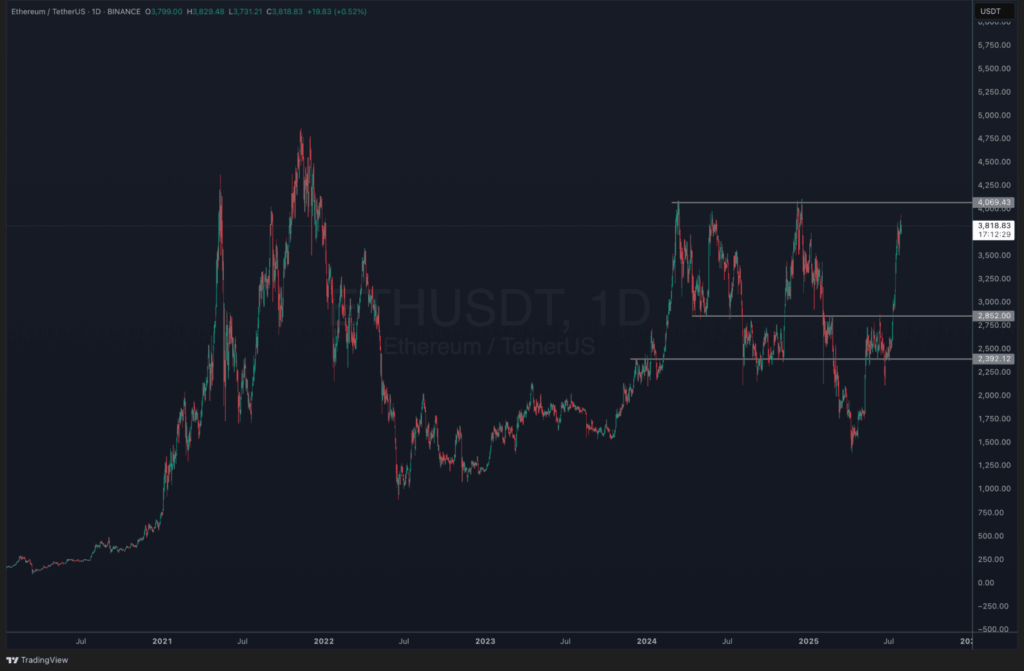

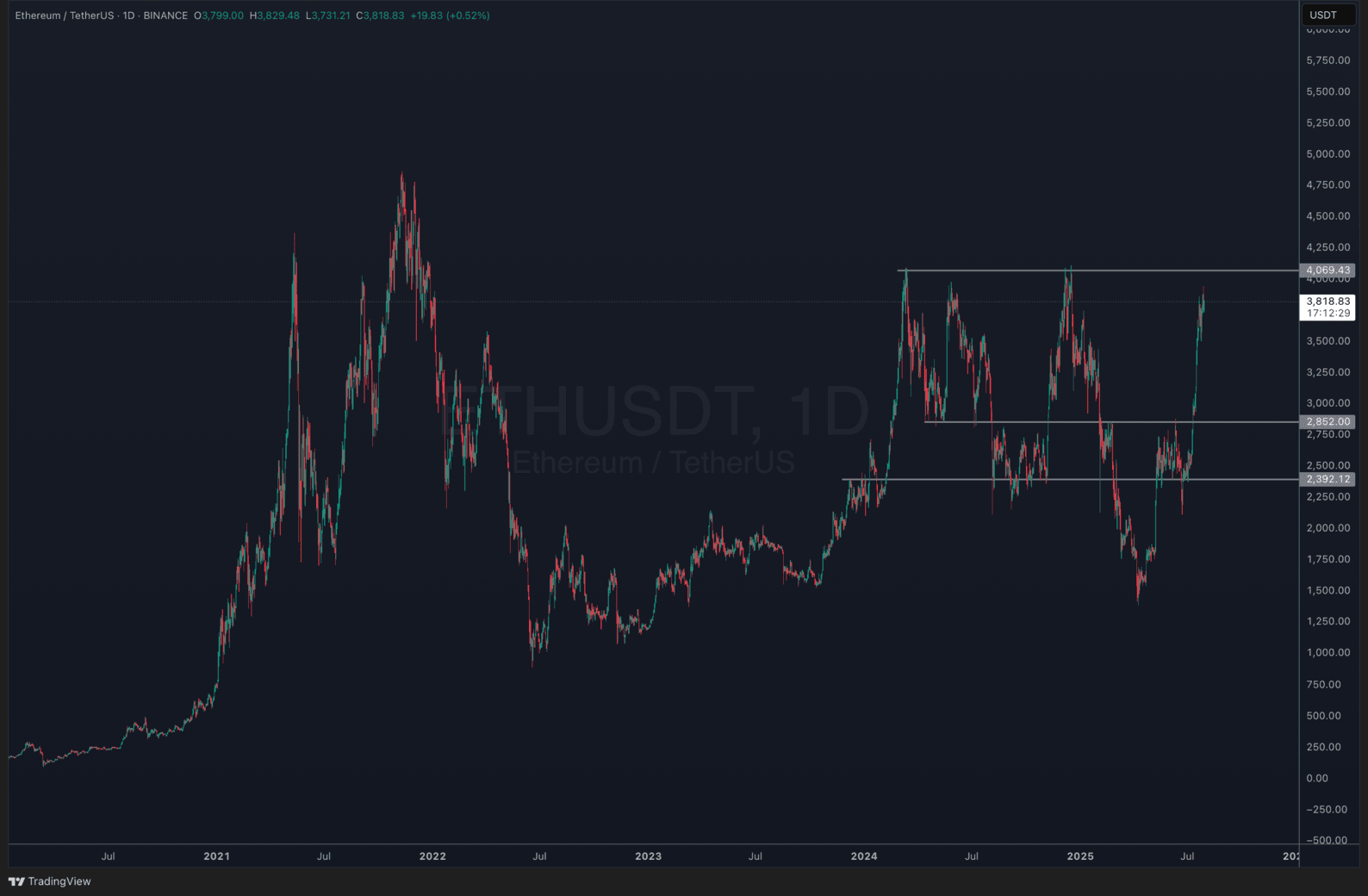

(ETHUSDT)

Ethereum is approaching key resistance at $4,069 after a strong rally from below $2,400. A breakout could target $4,500–$5,000, supported by record ETF inflows. The structure favors bulls, but confirmation is needed above this level to sustain momentum. A new ETH ATH could kickstart the highly awaited altcoin season.

At the same time, Hyperliquid (HYPE) is also making numbers. Built on a custom Layer 1 optimized for high-speed, on-chain perpetuals, it offers gasless, low-latency execution and deep order books.

As traders seek alternatives to centralized exchanges, Hyperliquid’s blend of performance and transparency positions it as a top choice for advanced users. Its rapid growth and strong developer activity make it a key altcoin to watch. Currently trading at $43,93, HYPE could be aiming for the $100 target next.

Solana, meanwhile, has regained momentum after past network issues. With fast transactions and minimal fees, it’s once again a hub for DeFi, NFTs, and tokenized assets. Upgrades like Firedancer have boosted reliability, while rising user activity and institutional interest support continued upside. SOL remains a leading Layer 1 with long-term growth potential.

SharpLink (SBET) Boosts Ethereum Holdings to 438K ETH, Stakes Over 700 ETH

SharpLink (SBET), the self-proclaimed “MicroStrategy for Ethereum,” has grown its ETH reserves to approximately 438,190 ETH: valued at around $1.68 billion. Between July 21 and 27 alone, the firm acquired roughly 77,210 ETH for $290 million at an average price of $3,756.

This marks a major step in SharpLink’s aggressive ETH treasury strategy, which began on June 2. Since then, the company’s ETH-per-share ratio, dubbed “ETH Concentration”, has surged from 2.00 to 3.40, up 70% in under two months. Just last week, that figure stood at 3.06.

Beyond accumulation, SharpLink is also earning through staking. Cumulative staking rewards have reached approximately 722 ETH, further boosting its ETH position.

Vine Crypto Still On A Rally: Elon Musk Is “Bringing Vine Back”

Vine Crypto (VINE), a meme token launched on Solana earlier this year, saw a sharp uptick over the weekend, climbing 2.18% to trade at $0.1407. That might sound modest, but over the last two weeks, VINE has surged more than 246% and over 500% this month alone.

Remember Vine? The first edition of TikTok that literally damages people’s reward paths in their brains. Vine was shut down for a reason, despite being profitable. Now it might be back baby!

All the momentum for the vine traces back to one man: Elon Musk. On July 24, Musk tweeted, “We’re bringing back Vine, but in AI form,” triggering a massive rally and renewed interest in anything associated with the platform.

Whales Grab ETH as Galaxy Digital Dumps More Bitcoin: Is the Rotation Underway?

As Ethereum ETFs surge and whale wallets continue to snap up ETH, Bitcoin is facing renewed selling pressure from major players. Today, blockchain investigators at Lookonchain reported a new transfer of 3,782 BTC, worth approximately $447 million, from wallets linked to Galaxy Digital to exchanges. This follows Galaxy’s massive $9 billion BTC sale last week, executed on behalf of a Satoshi-era whale.

That historic transaction involved over 80,000 BTC and was reportedly part of an estate planning strategy. Most of the coins were sold via OTC and secondary markets, limiting the immediate impact on price. But with over $400 million now on the move, the market is bracing for a possible continuation of the sell-off.

Despite the dumping, Bitcoin remains surprisingly stable, trading around $118,944 at press time. ETF inflows appear to be cushioning the impact, with $157 million returning to BTC funds in the latest session (Coinglass).

Bitcoin Whales Dump, But Bitcoin Hyper (HYPER) Rockets With $400K Weekend Raise

As Galaxy Digital offloads billions in BTC and wallet-linked activity hints at more sell pressure, Bitcoin’s price remains surprisingly stable, hovering just 3% from its all-time high. Yet, the real action this week is also happening outside traditional markets.

Bitcoin Hyper (HYPER), a Bitcoin Layer 2 project, raised $400,000 over the weekend and the presale collected so far over $5.6 million.

With over $5.6 million raised, Bitcoin Hyper is gaining momentum fast. HYPER focus on speed, promising real rollups, a canonical BTC bridge, and near-instant settlement. Some analysts say it could be the next 100x presale.

Experts still believe Bitcoin is on track to reach $150,000 or higher this cycle. At this pace, the broader BTC ecosystem is expected to grow exponentially, and Bitcoin Hyper is positioning itself at the forefront of that momentum.

China Industrial Bank Fast-Tracks AI Stablecoin to Counter Dollar

China Industrial Bank (CIB) is stepping up its digital game with plans for an AI-enchanced stablecoin, aiming to push itself from the US dollar’s grip on global finance. This move forms part of its wider digital-to-smart bank transformation strategy.

The initiative reflects a calculated response to growing stablecoin adoption and evolving regulatory frameworks like the US GENIUS Act. While the AI angle remains mysterious, the project signals China’s intensifying ambition to build tech-forward financial tools with global reach.

World Liberty and New Wallets Snap Up Over $2.7B in Ethereum Since July

ETH accumulation continues. Trump’s World Liberty recently spent 1 million USDC to buy 256.75 ETH at a price of $3,895 about 24 hours ago.

So far, World Liberty has accumulated a total of 77,226 ETH, valued at around $296 million, with an average purchase price of $3,294. This position currently shows an unrealized profit of approximately $41.7 million.

In addition, a new wallet (0x286f) added another 12,749 ETH, worth about $48 million, 12 hours ago.

Since July 9, nine new wallets have collectively bought 628,646 ETH, totaling around $2.38 billion. This significant accumulation signals strong interest and confidence in Ethereum from fresh investors and large buyers.

The post Bitcoin Steady Above $118K Ahead of FOMC And ETH ETF Breaks Records – What Are The Best Altcoins to Invest In? appeared first on 99Bitcoins.