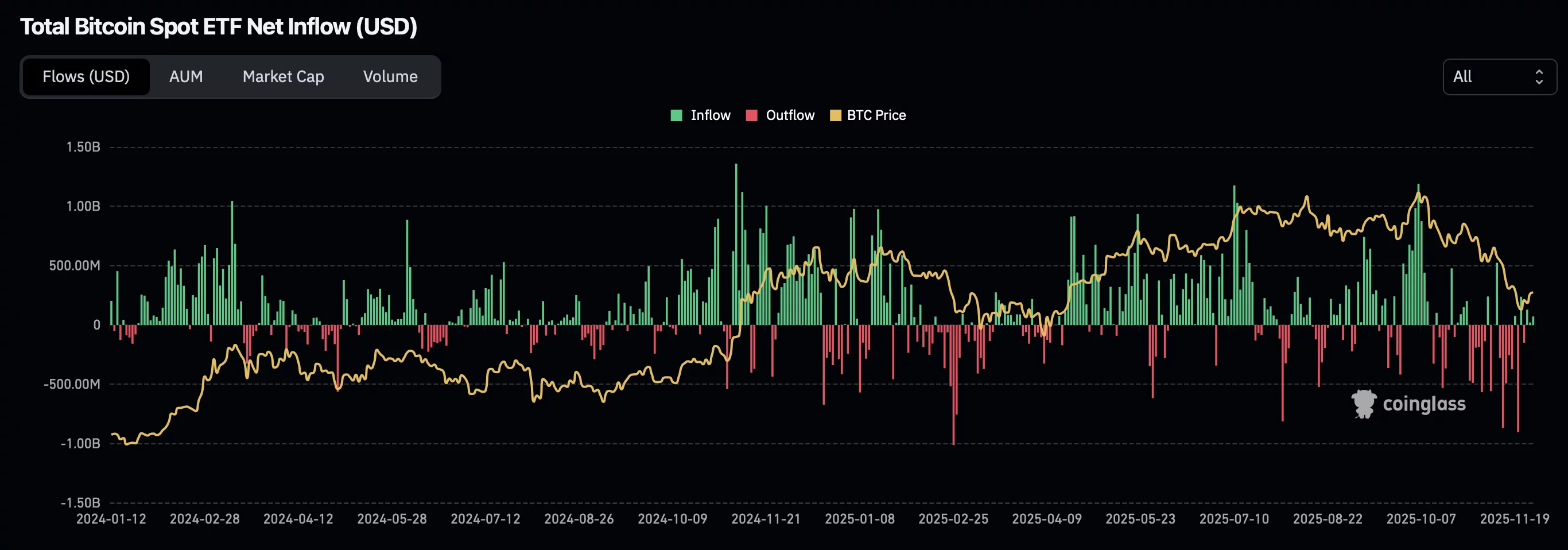

Bitcoin ETFs record worst month since February with $3.5B November outflows

Bitcoin ETFs suffered a record $3.79 billion in outflows in November as price weakness deepened, risk sentiment deteriorated, and investors rotated into alternative crypto assets.

Summary

- Bitcoin ETFs saw $3.79B in outflows, the most significant monthly withdrawal on record.

- Institutions shifted capital into Solana, XRP and thematic crypto ETFs.

- Macro headwinds and thinning liquidity amplified Bitcoin’s short-term downside pressure.

Bitcoin-linked exchange-traded funds, or ETFs, experienced their toughest month since launch, with nearly $3.8 billion withdrawn from spot Bitcoin funds in November. The heavy redemptions followed weeks of profit-taking, worsening macroeconomic sentiment, and a noticeable shift toward alternative crypto instruments.

These factors combined to put Bitcoin under meaningful short-term pressure, raising questions about whether this decline marks a structural trend or a temporary market rotation.

Key Bitcoin ETF developments

- Spot Bitcoin ETFs saw $3.79 billion in November outflows, the largest monthly total on record.

- BlackRock’s IBIT and Fidelity’s FBTC accounted for over 90% of redemptions, signaling large-scale institutional unwinding.

- One of the steepest days occurred on November 20, with nearly $903 million leaving ETFs in a single session.

November’s ETF exodus reflected a sharp reversal in institutional appetite for Bitcoin exposure. The asset spent much of 2025 rallying from the $90,000 region to new highs, giving investors an incentive to scale back positions when macro headwinds intensified. As interest rates remained elevated and global risk sentiment weakened, selling pressure intensified and ETF inflows flipped negative.

The heaviest redemptions were concentrated in the two dominant funds: IBIT and FBTC. Their outsized withdrawals shaped the entire month’s trajectory, highlighting that institutional desks, not retail investors, were driving the reversal. The nearly billion-dollar outflow on November 20 showed how aggressive the unwind became during peak selling.

However, capital exiting Bitcoin did not leave the crypto ecosystem entirely. Instead, institutional flows began shifting toward altcoin-focused ETFs, particularly Solana and XRP products. Solana ETFs reportedly saw more than $531 million in inflows, while XRP funds attracted over $400 million.

This suggests that investors are rotating toward assets they believe may outperform Bitcoin in the next phase of the market cycle, which is a notable difference from previous periods when Bitcoin dominated ETF demand.

Macro conditions added another layer of pressure: a strong U.S. dollar, ongoing inflation concerns and cautious central bank communication limited appetite for risk assets. As liquidity tightened into year-end, ETF redemptions accelerated, reinforcing Bitcoin’s declining momentum through the month.

A broader trend also emerged across institutional portfolios: reduced concentration in Bitcoin and increased allocation to thematic digital-asset exposure. Several trading desks shifted capital into ETFs tied to Web3 infrastructure, smart-contract platforms and tokenized real-world assets (RWAs).

This diversification shows a maturing institutional approach, but it also means Bitcoin is facing greater competition for capital in regulated markets. In the short term, this redistribution makes it harder for Bitcoin to maintain dominance when sentiment becomes defensive.

Despite the severity of November’s numbers, the environment is different from the 2022 crypto winter. There have been no major exchange collapses, no liquidity failures, and no widespread structural breakdowns. Instead, the decline appears linked to macro pressures and strategic rotation rather than internal issues within the crypto industry. The regulated ETF framework also provides a smoother pathway for capital to return once confidence improves.

What to expect in the coming developments

If ETF outflows continue to slow and macro pressures ease, Bitcoin may begin to stabilize as liquidity improves. Even modest inflows can tighten supply quickly in the post-halving environment. However, ongoing weakness in ETF demand could leave Bitcoin exposed to further near-term downside.